I’ve written about how you can qualify for a small business card. And quick small business ideas that can earn you lots of miles & points.

And recently, a Million Mile Secrets reader wrote to me about his excitement to apply for his first small business card, the Chase Ink Business Preferred. Before applying, he told me he was planning to move all of his business bank accounts to Chase in order to qualify for the card.

But having a business banking relationship is NOT a requirement for getting a credit card! So you’re eligible to apply for small business credit cards, even if you don’t make deposits for your business at the bank that issues the card.

I’ll share tips for getting a small business card.

Tips for Folks Considering Small Business Cards

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

Small business cards have lots of benefits. They can help you stay organized by separating personal and business expenses.

And they can help you earn lots of miles & points on everyday spending for your business. Because many come with bonus spending categories, which can get you up to 5X rewards on certain purchases.

Here are some tips if you’re thinking about getting a small business credit card.

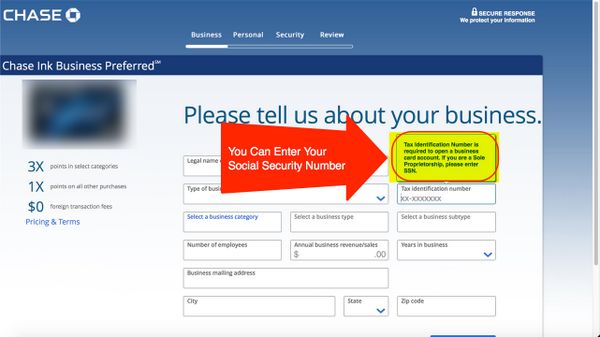

1. You Can Apply Using a Social Security Number

People sometimes think business cards are only for executives at large corporations. But that’s not the case!

You can qualify for a small business card as an individual doing work on the side. For example, if you’re a graphic designer, Airbnb host, or travel agent, you can qualify. The key is you must be looking to make a profit with your business to satisfy the bank’s requirements.

And if you’re an individual with a side business, you might not have a EIN (employer identification number). This is known as a sole proprietorship. If this is the case, you can apply for a business card using your Social Security Number.

Million Mile Secrets team member Keith has a part-time side business selling on eBay. He doesn’t have a formal corporation. So he enters his Social Security Number in his small business credit card applications.

2. Most Small Business Cards Do NOT Appear on Your Credit Report

Most banks do not report business cards on your personal credit report if you pay on time.

This is fantastic because some banks, like Chase, won’t approve you for their personal cards if you have too many new cards. And they typically count the number of recent cards you have based on what appears on your credit report.

So you can apply for small business cards with these banks to earn sign-up bonuses and not have a new account appear on your credit report:

- American Express

- Bank of America

- Chase

- Citi

- Wells Fargo

Team member Jesse says he has recently applied exclusively for small business cards to avoid having any additional personal cards count against his card limit with Chase.

Bottom Line

You’re NOT required to have a business banking relationship to qualify for small business credit card.

Remember, you can be approved for small business cards as an individual with a for-profit side activity, like selling on eBay or tutoring. Just enter your Social Security Number in the Tax Identification number field on the card application.

There are lots of terrific small business cards for folks looking to earn miles & points. And many do NOT appear on your personal credit report!

Written by Million Mile Secrets @ https://millionmilesecrets.com

Written by Million Mile Secrets @ https://millionmilesecrets.com