One of the best no-annual-fee credit cards that I recommend everyone keep in their wallet is the Chase Freedom Unlimited®. This card is one of the best ways to earn Chase Ultimate Rewards points for every purchase you make! You can turn Chase Ultimate Rewards points into cash back or you use them to book travel around the world!

The Chase Freedom Unlimited card earns 1.5% cash back (1.5X Chase Ultimate Rewards points per $1) on all your purchases. As the card name implies, your earning potential is unlimited because there are no caps on the amount of cash back you can earn.

Chase is currently offering a sign-up bonus of $150 cash back (15,000 Chase Ultimate Rewards points) when you you spend $500 on purchases in your first 3 months from account opening.

Once you get your Chase Freedom Unlimited card in the mail, I’ll help you keep track of everything you should do with an easy-to-follow checklist.

You can apply for the Chase Freedom Unlimited card here.

Chase Freedom Unlimited $150 Bonus (15,000 Chase Ultimate Rewards Points) Offer

Link: Apply for the Chase Freedom Unlimited

Our Review of the Chase Freedom Unlimited

With the the Chase Freedom Unlimited, you earn 1.5% cash back (1.5X Chase Ultimate Rewards points per $1) on all your purchases with no caps. You can earn a sign-up bonus of $150 cash back (15,000 Chase Ultimate Rewards points) when you you spend $500 on purchases in your first 3 months from account opening.

You can also earn an additional $25 (2,500 Chase Ultimate Rewards points) for adding your first authorized user and making your first purchase within this same 3-month period, which would give you a combined 17,500 Chase Ultimate Rewards points!

Once you get your Chase Freedom Unlimited card in the mail and activate it, there are few things to remember! Here’s what to know.

Step 1. Mark Your Calendar for When the Minimum Spending Requirement is Due

The welcome offer from Chase is $150 cash back (15,000 Chase Ultimate Rewards points) after spending $500 on purchases in the first 3 months from account opening. One important thing to remember is this is 3 months from the day you open the account, NOT 3 months from when you receive and activate your card! So make sure you start the 3 month clock from the day you’re approved for the card to be safe!

While you will probably want to use the Chase Freedom Unlimited card to make the majority of your daily purchases, here are some other ideas for ways to meet your minimum spending requirements.

Step 2. Set Up Your Card as the Default Payment Method Wherever You Shop!

Because the Chase Freedom Unlimited earns 1.5% cash back (1.5X Chase Ultimate Rewards points per $1) on ALL purchases, you will want to use this card for the majority of your daily everyday spending, especially purchases that don’t fall under a bonus category with other cards. Go ahead and add the card as your default payment method on sites like Amazon and Google Pay / Apple Pay.

One thing to keep in mind is the other cards you currently have in your wallet. If you are looking to pair your card with other Chase cards like the Chase Sapphire Preferred® or the Chase Sapphire Reserve®, you’ll want to make sure you use those cards where appropriate to make the most of the Chase Ultimate Rewards points you earn! For example, you’d want to use the Sapphire cards for all your dining or travel purchases such as Uber, grabbing lunch with a co-worker, or booking flights.

However, if you don’t yet have one of the Sapphire cards, go ahead and set the Chase Freedom Unlimited card as your default payment method in apps like Uber and Lyft to make sure you earn the most points.

Step 3. Familiarize Yourself With the Chase Shopping Portal

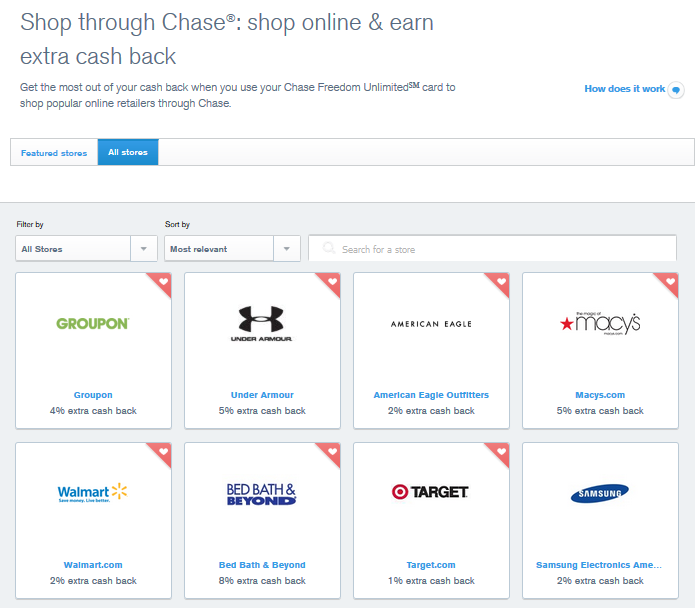

The Chase Shopping Portal is the best place to supercharge your rewards earning! Once you set up online banking for your new Chase card, visit the Ultimate Rewards dashboard and look for the “Earn Bonus Points” section. While you will always earn the standard 1.5% cash back with the Chase Freedom Unlimited, the Chase Shopping Portal lets you earn an additional 1 to 15% cash back (1 to 15 Chase Ultimate Rewards points per $1) for shopping at various sites like Target, Walmart, and Macy’s to name a few.

When you are ready to shop on one of those sites, just navigate to the website by going through the portal, shop like you normally would, and make sure to pay with your Chase Freedom Unlimited card. The best thing about the Chase Shopping Portal is you earn bonus points for doing the same shopping you’d do anyway!

Step 4. Learn to Combine Chase Ultimate Rewards Points Between Your Chase Cards!

Another important feature of Chase Ultimate Rewards points is that you can transfer your points between cards. That means, if you have an annual-fee Chase Ultimate Rewards points earning card, you can earn points on daily spend using the Chase Freedom Unlimited and then move those points over to the premium cards.

By moving your points to cards like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Unlimited, you’ll unlock the ability to book paid travel through the Chase Ultimate Rewards Travel Portal at a better rate.

|

Or for even better value, after combining your points, you can transfer them to one of Chase’s airline or hotel partners, like United Airlines, Hyatt, or Flying Blue to book award travel.

Chase Freedom Unlimited $150 Bonus (15,000-Point) Offer

Link: Apply for the Chase Freedom Unlimited

Our review of the Chase Freedom Unlimited

Remember, with the the Chase Freedom Unlimited, you earn 1.5% cash back (1.5X Chase Ultimate Rewards points per $1) on all your purchases with no caps. Chase is also currently offering a welcome bonus of $150 cash back (15,000 Chase Ultimate Rewards points) when you you spend $500 on purchases in your first 3 months from account opening.

You can also earn an additional $25 (2,500 Chase Ultimate Rewards points) for adding your first authorized user and making your first purchase within this same 3-month period, which gives you a combined 17,500 Chase Ultimate Rewards points!

Once you get your Chase Freedom Unlimited card in the mail and activate it, remember to go through the 4 steps above to make sure you are making the most of the rewards you earn and getting your Chase Ultimate Rewards point balance to skyrocket!

For those who already have the Chase Freedom Unlimited card, what made you decide to get the card? We’d love to hear in the comments below!

Written by Million Mile Secrets @ https://millionmilesecrets.com

Written by Million Mile Secrets @ https://millionmilesecrets.com